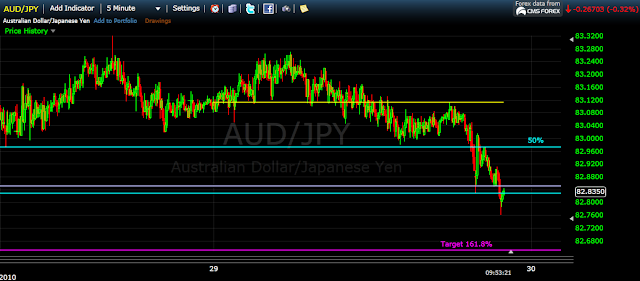

It has been noted in previous posts that the AUD/JPY pair has been highly correlated to the S&P 500. However, recently, the pair has drifted sideways while the S&P 500 has been making new highs. Looking at today's action, the AUDJPY has started to keel over.

Wanted to note that the Slow stochastic on the daily looks like it is heading south indicating that momentum has shifted to the downside. You can argue there is a bearish divergence from the Dec 20th low to now. As the Slow Stoch has declined dramatically the last 3 days.

Here is a closer look at today on a 15min chart.

On the 15 min chart you can see that as the markets in Asia have opened the AUDJPY pair fell off sharply. The MACD shows a failure to break the 0 level. Overnight if this pair heads much lower the US markets could be in a bit of trouble.

The white line that is in both graphs is a relatively significant level. If this breaks decisively, 81.50 could be a likely resistance point and stronger resistance should be felt at 80.00 level.

UPDATE:

2.5 hours after that drop, it looks like a retest of that 82.84 level is imminent. The target for a break out would be 82.65. MACD looks bearish and however the pair is getting over sold.

UPDATE 2: 9:54pm

The level mentioned above broke therefore the target is expected to be 82.66 which is a Fib projection of the impulse down.

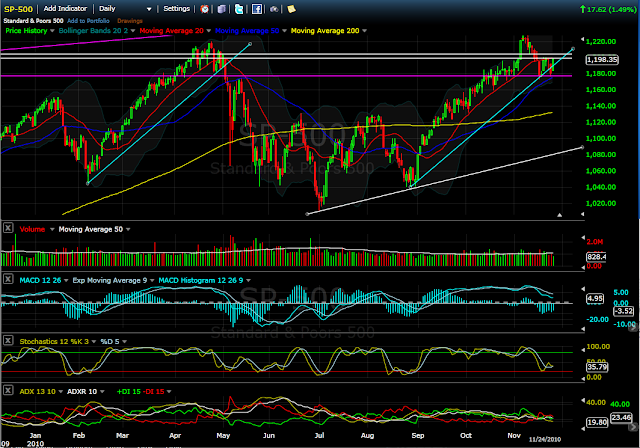

The S&P500 has continued its low volatility climb to the upside. However it is approaching the wave 1 = wave 5 target.

I mentioned before that the target was around 1283-1285, and should occur around Jan 1st. I think the Jan 5th time frame is more likely, and that also fits to with the fact that holidays are still here. I have suspected that the first normal trading week in January will be interesting, with the options expiration week of the 22nd being extremely volatile. Remember during this week, with everyone's expectations that the market will go up forever, big players will want to eliminate the need to pay options that are in the money.

A note on the technicals, the MACD again looks like it is getting tired and could cross over, however, the Slow Stoch is locked in above the 80 line. It could be expected that when that K line drops below the 80, the selling pressure will mount. Be cautions up in the area we are in now. There is a lot of uncertainty in the markets.

John Degoey was on BNN and mentioned these Canadian ETFs that are pretty interesting: ZJO, XMA, CBR.